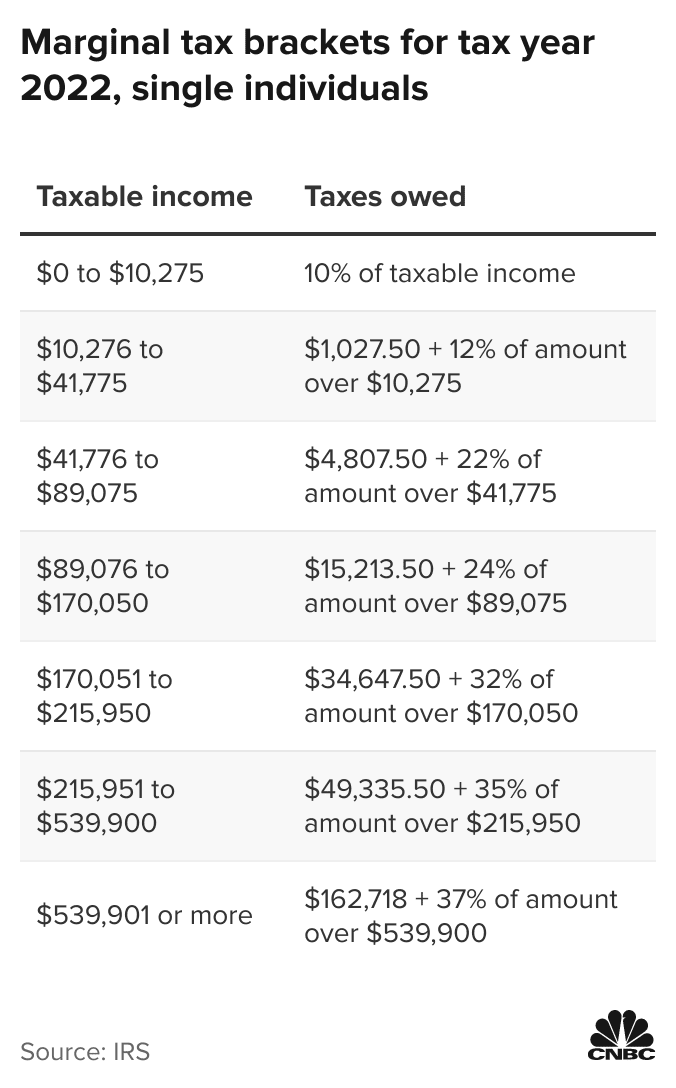

Estimated 2022 tax brackets

Inflation adjusted amounts in the tax code will increase by roughly 71 from 2022 more than double last years increase of 3 according to the 2023 Projected US. There are still seven tax rates in effect for the 2022 tax year.

2022 Income Tax Brackets And The New Ideal Income

15 61 a Multiply line 15 by 90 66 ⅔ if engaged in farming or fishing.

. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Estimated 2022 federal agi 90000 federal tax subtraction 7250 oregon itemized deductions 14750 total deductions and modifications 22000 estimated 2022 oregon taxable income. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Below are income tax rate tables by filing status income tax bracket tiers and a breakdown of taxes owed. Based on your projected tax withholding for the year we can also estimate your tax refund or. There are seven federal income tax rates in 2022.

Ad TurboTax Offers A Free Calculator For You To Easily And Accurately Estimate Your Refund. You expect to owe at least 1000 in tax for 2022 after subtracting your withholding and refundable credits. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. For example in 2021 a single filer with taxable income of 100000 will. If zero or less enter -0-.

Your marginal tax rate or tax bracket refers only to your highest tax ratethe last tax rate your income is subject to. The top marginal income tax rate. Under the previous governments plans the rate of Corporation Tax was to increase from 19.

According to the Medicare Board Trustees Report from 2019 the surcharges will inflate at as follows through 2028. Your 2021 Tax Bracket To See Whats Been Adjusted. Corporation Tax rise cancellation factsheet.

This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax. You expect your withholding and refundable credits to be less than the. CBO has since issued a revised estimate that says those earning less than 400000 will only pay a small fraction of the increased tax revenues that are expected as a.

Published 23 September 2022. 2022 Form NC-40pdf. The Premium Amounts per IRMAA Bracket.

Total Expected Gross Income. The 0 rate is applied to the first 25000 of taxable. Ad All Tax Brackets Supported.

PDF 49105 KB - January 24 2022. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators. Up to 10 cash back TaxActs free tax bracket calculator is an easy way to estimate your federal income tax bracket and total tax.

You can also create your new 2022 W-4 at the end of the tool on the tax. 15 Nebraska 2022 estimated income tax line 13 minus line 14. 16a bEnter the tax shown.

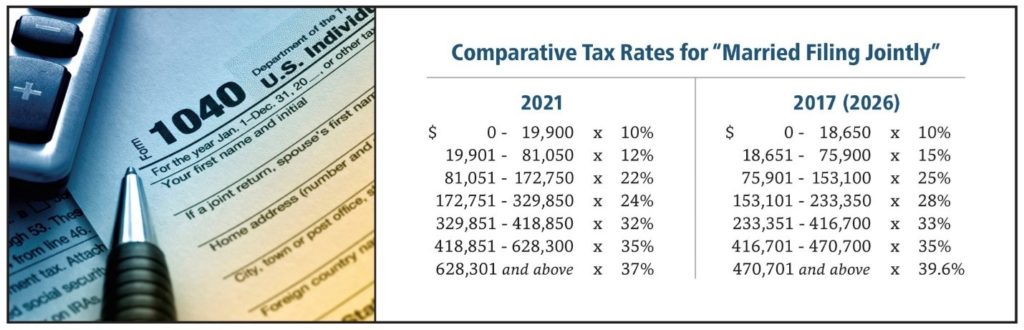

Individual Estimated Income Tax. Married couples who file joint tax returns have a 2022 standard. Tax Rates and Brackets Tables for Tax Year 2021.

Discover Helpful Information And Resources On Taxes From AARP. Ad Compare Your 2022 Tax Bracket vs. When it comes to federal income tax rates and brackets the tax rates themselves didnt change from 2021 to 2022.

Alaska imposes a corporate tax on business income at rates that are progressive and currently range from 0 to 94. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Those earning between 13900 and 215400 are subject to marginal tax decreases as the corresponding rates decreased from 59 percent and 633 percent to 585.

Get the Credits Deductions Refund You Deserve. Effective tax rate 172. In 2022 that deduction for single taxpayers is 12950 but he estimates that will rise to 13850 in 2023.

Enter your filing status income deductions and credits and we will estimate your total taxes.

2022 Tax Inflation Adjustments Released By Irs

2022 Income Tax Brackets And The New Ideal Income

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

2022 Income Tax Brackets And The New Ideal Income

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Start Planning Now For A Higher Tax Environment Pay Taxes Later

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Inflation Pushes Income Tax Brackets Higher For 2022

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks